Hard Money Georgia Things To Know Before You Buy

Wiki Article

The Greatest Guide To Hard Money Georgia

Table of ContentsThe 8-Second Trick For Hard Money GeorgiaNot known Facts About Hard Money GeorgiaFascination About Hard Money GeorgiaHard Money Georgia - An OverviewThe smart Trick of Hard Money Georgia That Nobody is Talking AboutThe Facts About Hard Money Georgia Revealed

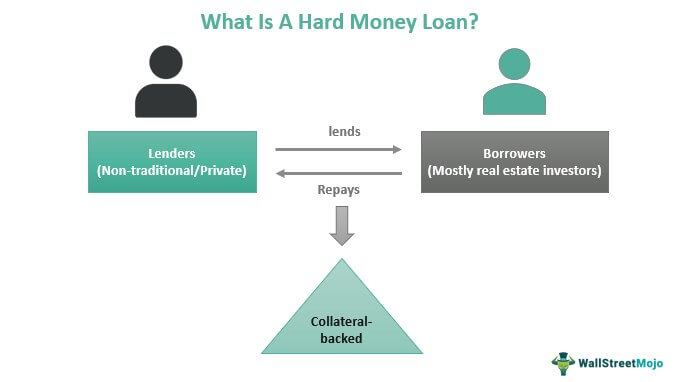

A hard cash funding is a specific financing device that is frequently used by expert investor. Expert real estate investors know the ins and also outs of hard money car loans, yet much less knowledgeable financiers need to inform themselves on the subject so they can make the very best decision for their particular job.In most cases the authorization for the difficult money lending can happen in simply one day. The difficult money lender is mosting likely to think about the residential or commercial property, the quantity of down repayment or equity the debtor will certainly have in the residential or commercial property, the borrower's experience (if relevant), the departure technique for the home as well as ensure the customer has some money gets in order to make the month-to-month funding repayments.

Investor that have not formerly utilized difficult cash will be amazed at exactly how quickly hard cash fundings are moneyed contrasted to financial institutions. Compare that with 30+ days it considers a bank to fund. This fast financing has conserved many actual estate investors that have actually been in escrow only to have their original loan provider pull out or merely not provide.

The smart Trick of Hard Money Georgia That Nobody is Discussing

Their listing of needs enhances yearly and a lot of them seem arbitrary. Banks also have a list of concerns that will certainly increase a red flag and stop them from even thinking about providing to a debtor such as current foreclosures, brief sales, funding alterations, as well as insolvencies. Poor credit history is one more variable that will avoid a bank from providing to a customer.Fortunately genuine estate investors who might currently have several of these concerns on their document, tough cash lending institutions are still able to lend to them. The tough money loan providers can provide to borrowers with issues as long as the consumer has sufficient down settlement or equity (at the very least 25-30%) in the residential or commercial property.

In the situation of a possible borrower who intends to purchase a key residence with an owner-occupied hard money loan with a private home loan lender, the borrower can originally purchase a property with tough money and after that work to repair any type of problems or wait the essential amount of time to remove the problems.

Our Hard Money Georgia Ideas

Banks are additionally unwilling to provide residence car loans to customers who are freelance or presently do not have the called for 2 years of work history at their present setting. The debtors might be a suitable prospect for the financing in every other facet, yet these arbitrary demands protect against financial institutions from expanding financing to the borrowers (hard money georgia).In the instance of the customer without sufficient work history, they would certainly be able to refinance out of the difficult cash car loan and also right into a reduced price conventional car loan once they got the needed 2 years at their present setting. Tough cash lending institutions provide several fundings that standard lending institutions such as financial institutions see here have no rate of interest in funding.

These jobs entail a real estate investor buying a residential property with a short term car loan to make sure that the investor can promptly make the required repair services and also updates and then sell the residential property. The actual estate investor just requires a 12 month finance. Financial institutions wish to provide money for the lengthy term as well as enjoy to make a percentage of rate of interest over an extended period of time.

Excitement About Hard Money Georgia

The problems might be related to foundation, electrical or pipes and can trigger the financial institution to consider the residential property uninhabitable as well as incapable to be moneyed. and also are unable to think about pop over here a funding situation that is beyond their rigorous loaning requirements. A difficult cash lender would be able to provide a customer with a financing to acquire a building that has issues preventing it from receiving a standard financial institution funding.

While the rate, reduced requirements and also versatility of difficult money lendings guarantees genuine estate financiers have the capital they need to finish their tasks, there are some aspects of hard money fundings that can be taken into consideration less than perfect. Hard money finance rates of interest are constantly going to be more than a standard bank loan.

Tough money lenders likewise charge a lending origination cost which are called points, a percent of the car loan quantity. Points normally vary from 2-4 although there are lenders who will certainly bill much higher points for certain scenarios. Certain areas of the country have many contending difficult money loan providers while various other areas have couple of.

The 15-Second Trick For Hard Money Georgia

In huge urban locations there are generally much more tough money lending institutions happy to provide than in even more remote backwoods. Debtors can profit greatly from examining prices at a few different lending institutions prior to devoting to a hard money lender. While not all difficult money lenders provide second home loans or depend on deeds on properties, the ones who do bill a greater rates of interest on 2nds than on 1sts. hard money georgia.

If passion rates go down, the borrower has the option of refinancing to the reduced present prices. If the rates of interest boost, the customer has the ability to maintain their lower rate of interest price loan and also lender is required to wait until the car loan comes to be due. While the loan provider is waiting on the financing to become due, their investment in the count on action is generating less than what they can receive for a new trust fund deed financial investment at current prices. hard money georgia.

The smart Trick of Hard Money Georgia That Nobody is Talking About

Financial institutions manage rate of interest price unpredictability by offering lower passion rates for much shorter terms and also greater interest prices for longer terms. For example, a three decades totally amortized car loan is going to have a much greater passion price than the 15 year totally amortized lending. Some consumers check out down settlements or equity needs as a hinderance that avoids them from getting a financing.Report this wiki page